Group Term Life Insurance – IRS Table

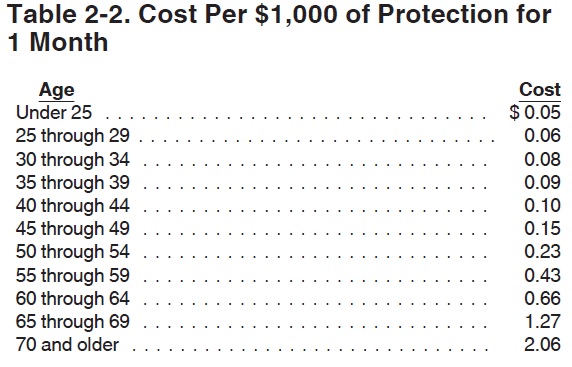

The following table represents the amount which must be added to income when an employer provided Life Insurance policy has a benefit value of greater than $50,000. For each extra $1,000 above $50,000 you would calculate an amount using the chart below and multiply by the number of months the benefit was provided (usually 12 months).

Cost Per $1,000 of group term Life Insurance protection for 1-Month Period.

For example, a 47-year-old pastor who receives a non-taxable life insurance policy of $100,000 for the entire year would have $90 added to his W-2, block 1 (and block 12 of his w-2 would show code “c” and 90).