FAQ List

We have compiled information for you based on what we would label our most frequently asked questions. Just click on the links below to retrieve the selected information.

Information Regarding Churches

Incorporate at the state level. It is not necessary to file IRS Form 1023 (which results in a hefty fee) and obtain formal recognition of your exemption. Incorporation at the state level insures your federal tax-exempt status.

As soon as you begin the process of incorporating at the state level you are considered a church in the eyes of the IRS. As soon as you obtain an EIN (Employer Identification Number) you can open a bank account and accept contributions for which you can give tax deductible receipts. File form SS-4 to request an EIN: Form SS-4 If you will have less than $4,000 a year in wages or less than $1,000 a year in withholdings (federal income tax, social security and Medicare) then you will have the option to choose to file an annual report (form 944) rather than a quarterly report (form 941).

SS-4 Employers file these forms to request a Federal EIN (Employer Identification Number). If you will have less than $4,000 a year in wages or less than $1,000 a year in withholdings (federal income tax, social security and Medicare) then you will have the option to choose to file an annual report (form 944) rather than a quarterly report (form 941).

W-4 All employees must fill out a W-4 for your records. This form determines how much federal income tax is withheld.

I-9 All employees must fill out an I-9 for your records. This form verifies the employee’s employment eligibility and must be retained by the employer.

W-2 All employees should be given a W-2 each year. For detailed instructions on filling out a W-2 for the pastor, see the booklet “The Pastor and His Income Tax”.

W-3 One W-3 should be prepared to accompany all your W-2’s. The W-3 acts as a face/summary sheet.

941 This is a quarterly form used to report wages and pay any taxes withheld by the employer (church). This must be filed even when no taxes are withheld. All employers must file this form if they pay wages (the definition of wages in this situation would not include housing allowance). Housing allowance is never included on this form so subtract the cash housing allowance before listing the wages on line 2. If all the employees are ministers no social security or Medicare wages are paid so be sure to check the box on line 4. When you file form SS-4 to obtain an Employer Identification Number, you will have the option to choose to file an annual report (form 944) rather than a quarterly report (form 941) if you will have less than $4,000 a year in wages or less than $1,000 a year in withholdings (federal income tax, social security and Medicare) then.

Some states require state income tax to be withheld by the employer. Be sure to check your state’s laws to determine your responsibility. You may be required to withhold state income tax from the pastor’s wages and file a state quarterly form to report and pay the amount withheld.

Incorporation documents should be kept forever. W-2s and payroll records should be kept forever. Any receipts or documents relating to investments or investment properties should be kept for 6 years after selling or disposing of the investment. All other receipts, statements, bills, check stubs, etc. should be kept for six years.

Any trade or business that is regularly carried on, which is not substantially related to the charitable purpose of the organization, produces unrelated business income. The fact that the income is used to create funds that are used to further the charitable purpose does not exempt the activity from taxation.

Exceptions:

1. Activities in which substantially all the work is performed by unpaid volunteers.

2. Activities carried on for the convenience of the members or employees.

3. Selling merchandise that has been received as gifts or contributions (such as a church bake sale).

4. Dividends, interest, annuities, royalties, capital gains and losses, and rents from real property:

Exception: Debt-financed Property – Property that is held to produce income and is subject to “acquisition indebtedness” (such as a mortgage) at any time during the tax year is unrelated business income unless:

85% rule – if 85% or more of the total property is used for exempt purposes then the income is not considered to be unrelated business income. If less than 85% of the property is used for the exempt purpose than that part of the property, which is not used for exempt purpose, is considered to be unrelated business income.

The neighborhood land rule – If an exempt organization acquires property with the intent of using it for exempt purposes within 10 years (15 years for churches) than income which is produced during that time is not unrelated business income. See IRS publication 598 for details.

Note: Rent on real property is considered unrelated business income when the rent is based on a percentage (such as a percentage of profit). Rent should be a flat rate in order to qualify for any of the exceptions above.

For more information see IRS Publication 598.

Pastors pay their Social Security and Medicare tax the same way a self-employed person would, through self-employment tax. This tax is 15.3% of income including the housing/parsonage allowance and is calculated on the Schedule SE that is filed with a minister’s tax return each year. They must pay Self-employment tax on their ministry income, including their housing allowance. When a pastor lives in a parsonage he also pays SE tax on the Fair Market Rental Value of the parsonage plus church paid utilities. Regular employees have an advantage when paying their Social Security and Medicare tax. Employers withhold half (7.65%) of every employee’s Social Security and Medicare tax from their wages. The employer pays the other half, and the employee does not pay any taxes on the employer’s “matching” part. Pastors pay the entire 15.3% without the benefit of a non-taxable “matching” employer part. Many churches have realized the tremendous burden this places on a pastor and his finances and are paying a 9.8% (7.65% = half of SE tax + additional amount to help offset the additional taxes incurred when the salary is increased) “matching” portion as additional salary.

According to the IRS gifts to staff members would be valued at under $25 and would never be cash or a gift card. Gift cards which are given for a specific item may qualify - such as a certificate for a one-pound box of assorted chocolates from a specified candy company. Otherwise, gift cards would never be a qualified gift. An example of a qualified gift to an employee would be a turkey at Thanksgiving. Cash gifts which are given to employees, pastors or volunteers are always taxable compensation.

Contributions

Yes, there are several steps you can take to protect your church and those that handle money.

1) Offerings should be kept in a locked/controlled situation and counted as soon as possible.

2) Offerings should be counted by two individuals who are not related.

3) The results should be reported on a tally sheet and signed by both counters.

4) The treasurer (not a counter) receives a copy of the tally sheet.

5) The treasurer compares the tally sheet with the bank statement.

Donors are only able to deduct their charitable contributions when contributing to a 501(c)3 organization (such as a church) and if they are able to obtain a receipt. Therefore, it is advantageous for churches to give receipts to their donors. A receipt should include the name of the church and the amount and date of the contribution. The receipt should also include the following statement: “No goods or services other than intangible religious benefits were provided in exchange for the contribution(s)”. Although the giving for the year may be added together and reported as one total, individual contributions of $250 or more must be itemized separately. Refer to IRS Publication 1771 for more information.

According to the IRS churches are not appraisers and should not assign a value to a gift of property. A donor should be provided with a receipt which includes the name of the church and the date of the contribution. The receipt should also include a detailed description, but not a value, of the donated property. When the donated property is a vehicle, the church should prepare Form 1098-C and provide a copy to the donor as a receipt. The value of time or services is not deductible and cannot be receipted. See page 7 of IRS Publication 526 for more information.

Designated Contributions are contributions made to the church for a specified purpose. Usually, a donor designates his contribution to a specific fund or to an individual.

According to Revenue Ruling 62-113 contributions earmarked for a particular individual are treated as being gifts to the designated individual and are not deductible. Churches should not issue tax-deductible receipts for contributions that are designated for individuals. Exception: Contributions earmarked for individuals who are employed or supported by the church are deductible when the church maintains control of the funds. This would include pastors and missionaries. When these funds are paid to the pastor or missionary as part of their support, they become taxable income and are included on their W-2. Contributions received for missionaries should be sent to the mission board or the employer who issues the W-2 so that these amounts can be included on the W-2 when appropriate.

One way to ensure that the church maintains control is to have a written policy regarding designated contributions. This policy should state that the church (or established team such as a finance committee or board) has exclusive control and discretion as to the use of all contributions and the church is not bound to honor the recommendations of the donors nor will donors be able to recover a contribution because the church failed to honor the donor’s designation. Honoring a donor’s designation encourages future giving and generates goodwill. It is in the best interest of churches to honor such designations whenever the designation is in line with the church’s ministry purpose.

When the contribution is designated to an individual who is not an employee of the church:

(1) Return the check to the donor or

(2) Accept the check but stamp it “NONDEDUCTIBLE” on its face with red ink.

When the contribution is designated to a fund or for a specific purpose:

(1) Use the funds as designated by the donor or

(2) Contact the donor and request permission to use the funds in a different way.

Organizations are required to provide a written acknowledgment to a donor who receives goods or services in exchange for a payment in excess of $75. If a donor gives you a gift of $100 in exchange for concert tickets with a fair market value of $40, then you must provide a written acknowledgment because their gift exceeded $75. The donor will not be able to deduct more than $60. The written acknowledgment must include the name of the organization, the date and amount of the gift, and the following statement “In exchange for your contribution, we gave you __________ with an estimated fair market value of ____.” Goods and Services are considered to be insubstantial if (1) the fair market value of the benefit does not exceed 2% of the contribution or $76 or (2) the gift is at least $43, and the only items provided bear the organization’s name or logo and the cost of these items is less than $8.60.

The IRS provides the following 3 examples of written acknowledgments:

- Thank you for your cash contribution of $300 that First Baptist Church received on December 12, 2020.

- Thank you for your cash contribution of $350 that First Baptist Church received on May 6, 2020. In exchange for your contribution, we gave you a cookbook with an estimated fair market value of $60.

- Thank you for your contribution of a used oak baby crib and matching dresser that First Baptist Church received on March 15, 2020. No goods or services were provided in exchange for your contribution.

Generally, organizations send acknowledgments to donors no later than January 31 of the year following the donation. That’s because donors must receive the acknowledgment by the earlier of 1) the date on which the donor files his or her individual federal tax returns for the year of the contribution; or 2) the due date of the return (including extensions).

Payroll/Record Keeping

Typically, we do not recommend a two-signature requirement because it can become cumbersome. Some churches may require two signatures when a check exceeds a maximum amount such as $5,000. The pastor(s) should not be a signer on the checks.

W-2s should be kept forever, and all other receipts, statements, bills, check stubs, etc. should be kept for six years. Any receipts or documentation relating to incorporation should be kept forever.

Every couple of years someone(s) from within the church should conduct an internal audit focusing on procedures as their main objective.

Block 1 – Wages, tips, other compensation

This amount would not include any designated housing allowance. Include all other wages, bonuses, gifts, non-substantiated reimbursements, the value of any non-cash gifts, and any other amounts given to the pastor that are not qualified fringe benefits.

Block 2 – Federal income tax withhold

Include any amounts you withheld from the pastor’s wages and paid by filing IRS form 941.

Block 3 – Social security wages

This block should have a zero or the word “none” in it. Ministers are not employees for Social Security purposes, and they do not have Social Security wages through their employers (churches).

Block 4 – Social security tax withheld

This block should have a zero or the word “none” in it. Ministers are not employees for Social Security purposes, and they do not have Social Security tax withheld through their employers (churches).

Block 5 – Medicare wages and tips

This block should have a zero or the word “none” in it. Ministers are not employees for Medicare purposes, and they do not have Medicare wages through their employers (churches).

Block 6 – Medicare tax withheld

This block should have a zero or the word “none” in it. Ministers are not employees for Medicare purposes, and they do not have Medicare tax withheld through their employers (churches)

Blocks 7 – 11

Leave these blocks blank.

Block 12 -

Employee benefits are reported in block 12. A code is listed to identify the type of benefit and the amount provided is listed following the code. Here is a list of the most common codes used by churches:

The value of group-term life insurance which is also included in block 1: “C”

The elective deferred salary contributed to a 401(k)-retirement plan: “D”

The elective deferred salary contributed to a 403(b)-retirement plan: “E”

Employer contributions to a medical savings account: “R”

Employer contributions to a health savings account: “W”

Block 13 -

Check the “Retirement plan” box if employee or employer contributions are made to a retirement plan.

Block 14 – Other

The housing allowance is reported here. List the amount of designated housing allowance and label it “Minister – see Schedule SE Housing Allowance”.

Pastors pay their Social Security and Medicare tax the same way a self-employed person would, through self-employment tax. As a result, it is incorrect to withhold and match Social Security and Medicare taxes for a minister. When these taxes have been withheld in error the quarterly 941(s) and W-2(s) need to be corrected. You will need an original W-2c and W-3c. The downloaded version of these forms is for informational purposes only. You may find forms at your post office or library. You may also call 1-800-TAX-FORM and ask for copies to be mailed to you.

You will need to know the following amounts when correcting your 941(s) and W-2(s):

1. The “total tax” you paid in error as Social Security and Medicare taxes.

2. Half of the amount of the “total tax” which will be referred to as the “half”. (This is also the amount which was withheld from the pastor’s wages.)

Correct your 941(s):

The following instructions should not result in an overpayment or an underpayment. The net result would be zero balance due.

1. Prepare new quarterly 941(s) correctly by not showing your minister’s income in column 1 of blocks 5a & 5c. Neither would you show any taxes for your minister in column 2.

a. Increase block 3 by the “total tax” you are no longer reporting in column 2 of blocks 5a & 5c. (This will move the amounts you paid for Social Security and Medicare into Federal Income tax withholding).

b. Increase block 2 by “half” of the amount you included in block 3. (This is because the matching portion of the Social Security and Medicare taxes need to be included in income.)

2. Prepare a 941-X showing the previously reported amounts (from your incorrectly submitted 941(s)) and the correct amounts (from the 941(s) you have just prepared).

3. Mail your 941-X to the address where you would file your 941(s) if you were not making a payment.

Correct your W-2(s):

1. Prepare Form W-2c.

a. Increase block 1 by the “half”.

b. Increase block 2 by the “total tax”.

c. Decrease blocks 3, 4, 5 and 6 to zero.

2. Mail the top copy of W-2c with a W-3c to:

Social Security Administration

Data Operations Center

Wilkes-Barre, PA 18769-0001

3. Keep a copy of the W-2c for your records and give the rest of the copies to the minister.

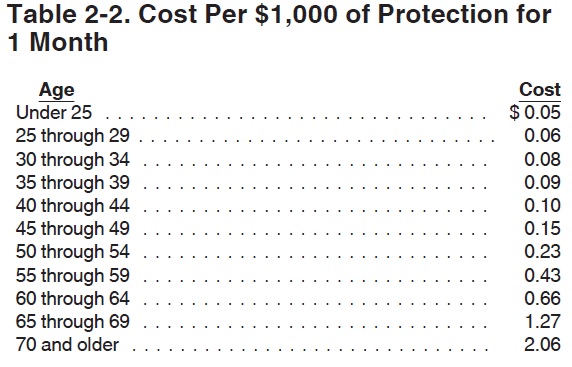

The following table represents the amount which must be added to income when an employer provided Life Insurance policy has a benefit value of greater than $50,000. For each extra $1,000 above $50,000 you would calculate an amount using the chart below and multiply by the number of months the benefit was provided (usually 12 months).

Cost Per $1,000 of group term Life Insurance protection for 1-Month Period.

For example, a 47-year-old pastor who receives a non-taxable life insurance policy of $100,000 for the entire year would have $90 added to his W-2, block 1 (and block 12 of his w-2 would show code “c” and 90).

Information Regarding Pastors

Pastors should have a cash salary that meets the physical needs of the family independent of the wife having to work.

In the middle 1960’s as a young accountant I began helping my pastor prepare his state and federal tax returns. Needless to say, I was surprised at his meager salary, lack of fringe benefits and his inability to provide for his future financially. His family lived in a church owned parsonage totally controlled by the church; they couldn’t even paint a wall without committee approval. It was a large farmhouse that was difficult to maintain and expensive to heat. I can remember visiting that parsonage and finding his wife in tears over the frustration of living under those conditions. I can remember thinking “this is not right”. Little did I know how that experience would begin to sow the seeds for the Stewardship Services Foundation. A ministry that would allow me to devote my energies to counseling pastors regarding finances, helping them to prepare their personal income tax returns and teaching church boards how to structure the pastors’ salary packages staying within the limits of IRS tax law. As a result, in 1977 the Stewardship Services Foundation ministry was born.

In this article I will attempt to discuss salary packages and their proper application in the budget process. The most important issue when it comes to this subject is attitude, a proper understanding by the board as it relates to the salary package issue including the desire to meet the needs of the family with a spirit of generosity. When a church calls a pastor (senior, youth, music, visitation, etc.) it is important to consider the following issues:

1. A cash salary to meet the physical needs of the family independent of the wife having to work. A good starting point would be to review his personal budget and build on it. A pastor who struggles to provide for his family is a pastor who will hesitate to teach Biblical stewardship from the pulpit. If he can’t live it, he shouldn’t teach it.

2. Full family medical plan that provides adequate health insurance and protects the family and the church from a catastrophic illness or accident. (Tax-free fringe benefit)

3. Disability Insurance – cash replacement that provides income and protects the family and the church due to a disabling illness or accident. (Can be a tax-free fringe benefit)

4. Retirement Plan – coupled with Social Security an amount that would give the pastor approximately 80% of his take home pay at retirement, assuming he has a debt-free home. If he has opted out of Social Security, which I do not advise, the plan must be more aggressive to meet his needs. I recommend the plan begin as early as possible with a minimum annual contribution of $2,400 building to $6,000 as soon as possible, and even more if he starts the plan after 40 years of age. Pastors should not be in IRA’s or Roth IRA’s. They should be in a 403-b pension plan where the deposits are made by the church which exempts the amount from self-employment tax and makes the distributions eligible for housing allowance upon retirement which would shelter it from Federal and State Income Taxes.

5. Life Insurance – $100,000 of term life insurance, paid by the church, with the wife as beneficiary – this protects the church and provides for the family upon a premature death. The church can pay the premiums on the policy but only the premium on the first $50,000 is a tax-free fringe benefit. The pastor should provide his own additional life insurance as needed, probably in the $500,000 range.

6. Professional Expense Reimbursement Fund – the IRS looks at a pastor as a businessman and recognizes that he incurs reimbursable professional expenses that allow him to perform his duties and should be paid by the church (automobile mileage, conferences, entertainment, supplies, anything pertaining to his responsibilities). In reality these expenses are incurred for the benefit of the church not the pastor.

I have advised churches for over 30 years to get out of the parsonage business.

7. Housing/Parsonage Allowance – I have advised churches for over 30 years to get out of the parsonage business. I think it is very important to get a pastor into his own home as soon as possible for many reasons. Retirement – owning a home at retirement is a key ingredient to retirement planning. Security – for his family particularly his wife, privacy – they can decorate how they want – it’s home. I think it tends to add to longevity – the family feels more attached to the community because there’s a stronger sense of belonging. Tax purposes – income tax law provides for generous benefits to the pastor who is buying his own home. Federal and state income taxes are greatly reduced and sometimes eliminated due to the housing allowance and the double deduction for mortgage interest and real estate taxes.

8. The self-employment tax is another issue that is often misunderstood – A pastor is a dual status employee. He is an employee for income tax purposes and self-employed for Social Security and Medicare purposes (called self-employment tax). Instead of paying 7.65% for his Social Security and Medicare and his employer paying 7.65% as all other employees do, he must pay 15.3% (less a small credit). I recommend the church include in his salary an amount that would cover the 7.65% that the church would normally pay if he weren’t the pastor. Because he must pay taxes on the additional 7.65% a proper increase would be 9.8%.

Note: A pastor pays the self-employment tax on the total of his wages including his housing allowance (if buying or renting). In the event that he lives in a church owned parsonage, he pays his self-employment tax on the total of his wages including the parsonage value and church paid utilities.

Now let’s express the above in a budget format:

This Pastor is 40 years of age, married and has 2 teenage children

Example – #1 – this pastor receives a cash salary of $45,000 per year and lives in a church owned parsonage with a monthly Fair Market Rental Value (FMRV) of $1600; the annual FMRV is $19,200. The church pays the utilities (which they should) that amount to $2,800 per year. His annual self-employment tax (Social Security) will amount to $9,467 ($45,000 + 19,200 + 2,800 = $67,000 x 92.35% = $61,875 x 15.3% = $9,467) of which the church agrees to pay $6,500 (9.8% of $67,000).

Pastor’s Financial Package

Cash Salary – (45,000 + 6,500) $51,500

Fringe Benefits: Medical Plan $700/mo. 8,400

Disability Insurance 1,500

Retirement Plan 9,000

Life Insurance 400

Total $70,800

The above pastor drives his car an average of 13,000 miles a year for the church which is reimbursed by the church at the current IRS rate of 67¢ per mile for a total of $8,710. In addition, he spends approximately $1,000 for conferences he and his wife attend, $400 for ministry related books and periodicals, $500 for meals he provides for counselees and church related guests in his home and $300 for miscellaneous expenses. A total of $10,910 is added to the church budget for church ministry expenses on a line item totally separate from the pastor’s financial package category.

Example #2 – Is the same as Example #1 except this pastor is buying his own home. An additional amount of $20,000 has been added to his cash salary and a $30,000 housing allowance is designated to cover his mortgage payment ($22,000), utilities ($3,200), real estate taxes ($2,300), insurance ($500) and maintenance ($2,000). The church has already been paying the utilities, insurance and maintenance of $4,700 for the parsonage in past years, so this portion of his increase is not new money. His annual self-employment tax will amount to $9,184 ($35,000 + 30,000 = $65,000 x 92.35% = $60,028 x 15.3% = $9,184) of which the church agrees to pay $6,370 (9.8% of $65,000).

Pastor’s Financial Package

Cash Salary (35,000 + 30,000 + 6,370) $71,370

Fringe Benefit: Medical Plan 700/mo. 8,400

Disability Insurance 1,500

Retirement Plan 6,000

Life Insurance 400

Total $87,670

The professional expense amount of $10,910 would appear in a line item in the budget separate from the salary package category. The pastor would be reimbursed from this line item as he accounts to the treasurer with all details including mileage logs and receipts. A church credit card can be used for many of these expenses.

I realize the above number may be currently out of reach for some churches. However, stewardship principles require each of us to be responsible with the resources and families he has entrusted to our care. A good procedure is to assign two board members to review the needs of the staff annually and make recommendations to the full board for consideration. When it comes to our pastors, we should take I Corinthians 9:14 and I Timothy 5:17 very seriously. Addressing all of the above issues at one time may be difficult but by prayer, planning and proper stewardship all the issues can be addressed.

An individual who is licensed, commissioned or ordained and performing the services of a minister. These services include:

- Performing sacerdotal functions (communion, baptizing, marrying, burying, etc.),

- Conducting religious worship, and

- Controlling, conducting and maintaining religious organizations that are under the authority of a religious body that is a church or denomination. (You are considered to control, conduct, and maintain a religious organization if you direct, manage or promote the organization's activities.)

No, the facts and circumstances will determine a minister’s employment status. Creating a contract or giving an individual a title or description in order to appear to be self-employed will not determine employment status – the facts and circumstances make the determination.

An employee should receive a W-2 and the employer should withhold and match Social Security and Medicare on his/her wages.Note: A church can hire a service, a general contractor, or an individual (if the individual is in business and offers his/her services to several churches/businesses) to provide miscellaneous services (i.e. yard maintenance, janitorial duties, secretarial duties, etc.). If a church chooses to hire an individual or church member then an employer/employee relationship has been established and proper employment forms must be completed.

If you pay a self-employed individual more than $600.00 (not including reimbursements or housing allowance), you must give the individual a 1099-MISC. There is no place to report housing allowance on form 1099-MISC.

An employing agency of a minister of the gospel is to treat the minister as dual-status. This means the minister has 2 status’ and is considered both an employee and self-employed: 1) He is an employee for federal income tax purposes and receives a W-2, and 2) he is self-employed for Social Security and Medicare purposes and does not have Social Security or Medicare withheld nor matched on his wages.

The most common error is for a church/mission agency to give their employed minister a 1099 as if self-employed. This error is many times compounded by the housing allowance, expense reimbursements, and fringe benefits. Fringe benefits are available to dual-status ministers not to self-employed individuals. If a minister of the gospel receives a 1099 and employee fringe benefits, he is receiving wrong treatments. These “before tax” benefits are for “dual-status” ministers who receive W-2’s. Self-employed 1099 individuals are not entitled to employee fringe benefits. The second most common error is for churches to withhold and match Social Security and Medicare taxes from a minister’s wages. This is further compounded when the church designates a housing allowance. Employees who have Social Security and Medicare taxes withheld do not qualify for a housing allowance. If a minister of the gospel has Social Security and Medicare taxes withheld, he is receiving wrong treatments. (Click here for instructions on how to correct this error.) For more information refer to IRS Publication 517.

Pastors are considered dual-status employees, which means they are treated as an employee for federal income tax purposes, and self-employed for Social Security/Medicare purposes. Being an employee, they do receive a W-2. Self-employment tax is simply the vehicle a self-employed individual uses to pay his Social Security/Medicare tax (SECA). Income (whether you are an employee or self-employed) is subject to both federal income tax and Social Security/Medicare tax. Employees pay their taxes throughout the year as their employers withhold taxes from their pay. The amount withheld for federal tax is figured based on the W-4 an employee fills out when employment begins. For Social Security/Medicare the employer withholds 7.65% (6.2% for Social Security tax and 1.45% for Medicare) from the employee's salary, then the employer matches that amount (pays an additional 7.65% which is not considered income to the employee). Self-employed individuals pay their taxes throughout the year by making quarterly estimated payments. This amount covers both their federal tax and self-employment tax (Social Security/Medicare). The amount they pay is only an estimate; they figure the actual amount when they file their yearly tax return.

A pastor’s options in paying taxes during the year are:

1. Your treasurer can withhold enough FIT (Federal income tax) to cover both the FIT and Social Security/Medicare taxes.

2. Your treasurer can withhold FIT and you can file Social Security/Medicare taxes quarterly on Form 1040-ES.

3. You can file quarterly on 1040-ES for all taxes.

4. Prepaying your state taxes by withholding or quarterly estimates may also be required.

The pastor pays federal taxes on the amount of his salary not including the actual expenses incurred for his designated housing allowance, and any tax-free fringe benefits. *

The pastor pays self-employment tax on his salary, his housing allowance, the fair market rental value of any church owned parsonage, including any church paid utilities. Other outside income, such as honorariums, would be included on Schedule C of the tax return and subject to self-employment tax.*

I have never recommended a minister in our fundamental circles to apply for exemption from Self-Employment Tax (Form 4361). The election to apply for exemption is very clearly not to be a financial decision. A minister must be “conscientiously opposed to... any public insurance that makes payments in the event of death, disability, old age, or retirement; or that makes payments toward the cost of…medical care.” In addition, this conscientious objection must be because of his religious principles. Any minister who files Form 4361 must notify his church that, because of his religious principles, he is opposed to public insurance. I see no scriptural support for opposition to public insurance, and therefore, I do not believe a fundamental minister of the gospel can sign such a statement. There is a general misconception about the election, which implies it to be a good financial decision. I would not concur with that notion! The Social Security program is a good one, and the benefits paid upon retirement are usually the only source of income a minister may have available. The important issue financially is self-discipline. Typically, those who have opted out of Social Security have not made adequate provisions for retirement, disability, and Medicare insurance.

We recommend that you call our office for counsel before you file form 4361 to apply for exemption from Self-Employment tax.The following steps should be taken in applying for exemption from Self-Employment Tax: 1) A prayerful and complete study of Scripture should be made, and notes recorded and kept for your records, documenting your conclusions with regard to public insurance. 2) Request Form 4361, Application for Exemption from Self-Employment Tax for Use by Ministers, Members of Religious Orders and Christian Science Practitioners, from the IRS. 3) Notify your church of your religious opposition to public insurance.4) Mail your completed Form 4361 to the appropriate IRS office, as indicated on the form, and keep a copy for your records. 5) When you receive your approval from the IRS (the approval will be a copy of your form 4361 with some sort of IRS stamp across the face of the application) make several copies and keep them in several different locations. If you are ever audited and cannot produce your approved exemption, you could be accessed penalties and interest and required to pay your Self-Employment Tax for the past three years.

The Form 1040 and Schedule SE should be kept forever, and all back-up to the tax return for six years.

Many of you have asked if it is possible to e-file your return. We cannot e-file the return for you since you are not in our presence, but you can e-file the return yourself. If you chose to do so, we would recommend www.freefilefillableforms.com. Unfortunately, we are unable to help with e-filing issues. We have tried over the years to offer help to others, but we were never able to successfully help anyone with their e-file efforts – not once. With so many failed attempts to try and help someone e-file and because of how time consuming those attempts proved to be, we have had to institute the policy that we cannot answer questions about e-filing.

It can be difficult to get an efiled return accepted by the IRS when there is clergy income. Over the years our own preparers have tried to efile their own personal tax returns with clergy income. They are regularly rejected. At times they can figure out why but there are times they have given up and mailed in a paper return.

You may also be able to efile your state return, but we do not have any recommendations as to what platform you use. You can efile the federal return and mail the state return or vice versa.

Because we prepare returns via U.S. mail and do not actually meet with each pastor individually we do not efile returns and unfortunately we do not have the time to add efiling to our tax season. In addition, we cannot help you when you run into problems (we have tried this in the past but without success).

If you wish to efile we would suggest that you use a service which allows you to fill in the actual forms yourself rather than one that calculates for you. A service such as "Free File Fillable Forms". Efiling a minister's tax return can be challenging - sometimes we can make it work and sometimes even we cannot.

W-2s should be kept forever, and all other receipts, statements, bills, check stubs, etc. should be kept for 3 years. Any receipts relating to capital expenditures or improvements (home improvements) should be kept for 3 years after the sale of a home. Any receipts or documents relating to investments or investment properties should be kept for 3 years after selling or disposing of the investment.

Fringe Benefits

1. Pay his salary based on a fair and livable wage (the principle of generosity).

2. Fringe benefits should include:

Full family medical insurance

Retirement plan (403b)

Disability insurance

$100,000 of term life insurance

Add value of $50,000 as income

3. Reimburse pastor for all professional expenses out of general fund category not compensation.

4. Church should pay portion of pastor’s social security obligation as a taxable bonus.

5. Help pastor buy his own home.

6. Give pastor and wife opportunity to attend three church conferences a year at church expense.

7. Church should give pastor four weeks of vacation per year including four Sundays.

Disability Insurance – The church can reimburse its pastor for this premium or pay it directly.

Health Insurance – Group health insurance plans are a qualified fringe benefit. If the church does not qualify for a group plan because there is only one employee, you will need to establish either a Medical Reimbursement Account or a Health Reimbursement Arrangement.

Health Reimbursement Arrangement – This is an amount which the church sets aside to be used for reimbursement of non-covered medical expenses. Left-over funds may be carried forward to the following year. An HRA is subject to discrimination laws and all employees would receive the same amount.

Housing Allowance – This is a part of the pastor’s salary which is designated to be available for housing costs. This needs to be approved by the board or church in writing and in advance of expenses. The portion of this designation which is used to provide housing is exempt from Federal Income taxes, but not self-employment tax (Social Security/Medicare).

Life Insurance – The church may provide up to $50,000 group term life.

Medical Reimbursement Policy – This is an amount set aside to be used for reimbursement of non-covered medical expenses. The funds are made available through salary reduction. This is a “use it or lose it” proposition, so any funds remaining at year end cannot be given as salary.

Reimbursement/Expense Account – The church must require receipts (it is not enough for the pastor to voluntarily substantiate his expenses). This is a “use it or loose it” proposition; any unused portion cannot become salary.

Tax Sheltered Annuity (403-b) – The church contributes directly to the financial institution chosen. The Pastor or church determines the amount of the contribution, which would exclude it from taxes.

Tuition Benefits for your dependents – The school must also be the employing body in order for this to be a tax-free benefit (i.e. the church and school are one corporation).

What benefits are taxable?

Health Insurance - Insurance obtained through a government website is taxable. Any amounts paid for individual policies are taxable (unless a one person stand-alone HRA or MRP is used).

Life Insurance – in excess of $50,000, or any policy which is not considered group term life.

Personal use of a Church/School owned Auto – a log must be kept to determine the value of this taxable benefit.

Reimbursements – when a Pastor is not required to substantiate or “pay back” the excess.

Tuition Benefits for your dependents – These benefits are considered a part of the Pastor’s taxable salary when the school is not a part of the church.

Option #1

The church/employer pays the Pastor a salary and reimburses all his professional expenses separately (from the general operating budget). This keeps the Pastor’s salary and professional expenses totally separate. Note, the Pastor must account to the church with receipts/mileage logs for those expenses to be reimbursed. This is the best method to use.

1. The Pastor accounts to the treasurer/bookkeeper monthly with his expenses and gets reimbursed with a separate expense check out of the professional expense category in the budget.

Option #2

The church/employer pays the Pastor a salary and the Pastor uses a salary reduction plan to make funds available for expense reimbursement. A portion of the Pastor's salary becomes a separate line item in the general operating budget. This keeps the Pastor’s salary and professional expenses totally separate.

1. The Pastor accounts to the treasurer/bookkeeper monthly with his expenses and gets reimbursed with a separate expense check out of the professional expense category in the budget.

2. If the Pastor does not use the total amount of budgeted expenses by the end of the year, he loses it – the unused portion belongs to the church. IT DOES NOT BECOME SALARY.

If you do not follow the procedures as the IRS stipulates for reimbursement, and they audit your return, they will declare your reimbursement as nonaccountable professional expenses. They will add your reimbursed expenses to your income.

As of the 2018 tax year employees are no longer able to deduct their business expenses from their federal income tax. The only way for a pastor to avoid paying income tax on their professional expenses is for their employer to reimburse these expenses. A church/employer may reimburse tax free each professional expense the pastor documents or the church/employer may utilize a professional reimbursement account. The reimbursement is not reported on the Pastor’s W-2. It is not income.

The following are examples of reimbursable (tax deductible) business expenses: Education – Tuition, fees, books, supplies, and (if the school is away from the pastor’s home area) transportation, meals, and lodging are reimbursable. Education expenses which qualify your pastor for a new trade or business (such as carpentry, etc.) are not reimbursable. Meal & Entertainment – Reimburse a pastor 100% of his cost for meals and entertainment. When his spouse is present because the spouse of the person being entertained is present, her meal is reimbursable. The cost of meals for the pastor’s children are never deductible. Mileage – The pastor should keep a log of his miles (including the mileage at the beginning and end of each year) and be reimbursed for his business miles at the standard mileage rate. Travel – The cost of train, airplane, boat, bus fare, auto rental, taxi, hotel, motel, meals, gratuities, telephone, travel insurance, baggage charges, cleaning, and laundry costs are reimbursable when a pastor travels on business. A pastor might travel to attend a church convention, a speaking engagement, to lecture, to perform a wedding or a funeral, to provide pulpit supply, an evangelistic meeting, on deputation, to church camp, etc.

Clothing which is adaptable for general wear, one subscription to a local newspaper (which the IRS claims must be personal), magazine subscriptions, tapes, and books which are purchased for personal reasons, travel expenses which relate to anyone other than the person earning an income, commuting miles, contributions, tithes, offerings, tuition expenses for your dependents, education expenses which do not relate to your ministry, taxes, or personal use of your computer.

Ministers should be reimbursed for entertainment expenses as these are greatly reduced when taken to the tax return. When reimbursement is not available these expenses may be included on the tax return.

RESTAURANT MEALS: The cost of meals when entertaining out-of-town ministry guests (visiting missionary, evangelist, etc.) is deductible. The cost of children’s meals are never deductible.

IN-HOME ENTERTAINING: Most ministers provide substantial entertaining in their home. The main expense of entertaining is the cost of meals and those meals usually consist of items which you have on hand rather than items which you purchase for the occasion. For this reason many pastors find it more convenient to use a per diem rather than an actual amount. Depending on your circumstances a reasonable per diem for a complete dinner might vary between $6 to $8 per person. Afternoon meetings with refreshments or after evening snacks for the youth group might vary between $1.50 to $2.50 per person. If you purchase many items during one visit to the grocery store you might wish to keep your receipt to validate the per diem amount you use.

A taxpayer must substantiate by adequate records or by sufficient oral or written evidence the following types of expenses:

1. Traveling expenses including meals and lodging while away from home.

2. Entertainment expenses.

3. Business gifts.

Since 1985, taxpayers have been required to answer questions on their returns regarding the business use of an automobile including:

1. The total number of miles driven during the year.

2. The total number of business miles driven during the year.

3. Whether the vehicle was used for commuting and, if so, the distance normally commuted.

4. Whether the vehicle was available for personal use in off-duty hours.

5. Whether another vehicle was available for personal use.

6. Whether adequate records or sufficient evidence exists to justify the deduction and whether or not the evidence is written.

Taxpayers are required to substantiate the following elements:

1. The amount of each expense or other item.

2. The time and place of the travel, entertainment, amusement, recreation, or the date and description of the gift.

3. The business purpose of the expense or other item.

4. The business relationship to the taxpayer of the persons being entertained, or receiving the gift.

Adequate records or sufficient evidence include the following:

1. Account books, diaries, and logs.

2. Documentary evidence (receipts, paid bills).

3. Trip sheets.

4. Expense reports.

5. Written statement of witnesses.

If a taxpayer does not have adequate records to substantiate his expenses, or if he cannot supply sufficient oral or written evidence thereof, no tax deductions or credits will be allowed with respect to an item. It should be noted that Congress has emphasized that different types of evidence have different degrees of probative value and that oral evidence alone has considerably less probative value than written evidence.

Pastors pay their Social Security and Medicare tax the same way a self-employed person would, through self-employment tax. This tax is 15.3% of income including the housing/parsonage allowance and is calculated on the Schedule SE that is filed with a minister’s tax return each year. They must pay Self-employment tax on their ministry income, including their housing allowance. When a pastor lives in a parsonage he also pays SE tax on the Fair Market Rental Value of the parsonage plus church paid utilities. Regular employees have an advantage when paying their Social Security and Medicare tax. Employers withhold half (7.65%) of every employee’s Social Security and Medicare tax from their wages. The employer pays the other half and the employee does not pay any taxes on the employer’s “matching” part.Pastors pay the entire 15.3% without the benefit of a non-taxable “matching” employer part. Many churches/employers have realized the tremendous burden this places on a pastor and his finances and are paying a 9.8% (7.65% = half of SE tax + additional amount to help offset the additional taxes incurred when the salary is increased) “matching” portion as additional salary.

Transportation

What is considered commuting miles?

Commute miles are from your home to your first business location and from your last business location to your home. Multiple trips you make throughout the day to your home are also considered commuting. Returning to the church from home for an evening meeting (such as a board meeting) would be considered commuting. Driving to church on Sunday would be considered commuting. Commute miles are always personal miles.When you leave the metropolitan area where you live and normally work you are no longer commuting. Miles from your home to a business location outside of the area would not be commute miles.

What is considered business miles?

Business miles are any miles which you drive from one business location to another. Such as from the church to the post office or from the church to visit a church member.Any miles you drive for business that require you leave the metropolitan area where you live and normally work are also business miles. Such as making a hospital visit to a member in a hospital which is located out of the area in which most of your church members live. In this case you may begin the trip from your home or any other location in your area.

When a church owns the vehicle driven by the Pastor and the Pastor uses the vehicle for personal use, an amount must be added to his income. Personal use is any use which is not church business. Commuting is considered personal use. The Pastor must log his miles and provide the church with a statement showing the business miles driven and the total miles driven.

Calculating Personal Use on an Employer Owned Vehicle

Subtract the pastor’s business miles from his total miles. This gives you his personal miles. Divide his personal miles by the total miles. This gives you the percentage of personal use. Using the Annual Leave Value table below, multiple the percent of personal use by the annual lease value (if the vehicle was not made available for the entire year, multiple by the fraction – the number of days available divided by 365). Add this amount to the Pastor’s income on his W-2, block 1*.

*If the employer provides the gasoline then add 5½ cents for each personal mile.

*If the employee provides the gasoline then deduct 5½ cents for each business mile.

Annual Lease Value

Generally, you figure the annual lease value of an automobile as follows.

1) Determine the fair market value (FMV) of the automobile on the first date it is available to any employee for personal use.

2) Using the following Annual Leave Value Table, read down column 1 until you come to the dollar range within which the FMV of the automobile falls. Then read across to column 2 to find the annual lease value.

| Annual Lease | Automobile FMV Value |

| $ 0 to 999 | 600 |

| 1,000 to 1,999 | 850 |

| 2,000 to 2,999 | 1100 |

| 3,000 to 3,999 | 1350 |

| 4,000 to 4,999 | 1600 |

| 5,000 to 5,999 | 1850 |

| 6,000 to 6,999 | 2100 |

| 7,000 to 7,999 | 2350 |

| 8,000 to 8,999 | 2600 |

| 9,000 to ,9999 | 2850 |

| 10,000 to 10,999 | 3100 |

| 11,000 to 11,999 | 3350 |

| 12,000 to 12,999 | 3600 |

| 13,000 to 13,999 | 3850 |

| 14,000 to 14,999 | 4100 |

| 15,000 to 15,999 | 4350 |

| 16,000 to 16,999 | 4600 |

| 17,000 to 17,999 | 4850 |

| 18,000 to 18,999 | 5100 |

| 19,000 to 1,9999 | 5350 |

| 20,000 to 20,999 | 5600 |

| 21,000 to 21,999 | 5850 |

| 22,000 to 22,999 | 6100 |

| 23,000 to 23,999 | 6350 |

| 24,000 to 24,999 | 6600 |

| 25,000 to 25,999 | 6850 |

| 26,000 to 26,999 | 7250 |

| 28,000 to 29,999 | 7750 |

| 30,000 to 31,999 | 8250 |

| 32,000 to 33,999 | 8750 |

| 34,000 to 35,999 | 9250 |

| 36,000 to 37,999 | 9750 |

| 38,000 to 39,999 | 10250 |

| 40,000 to 41,999 | 10750 |

| 42,000 to 43,999 | 11250 |

| 44,000 to 45,999 | 11750 |

| 46,000 to 47,999 | 12250 |

| 48,000 to 49,999 | 12750 |

| 50,000 to 51,999 | 13250 |

| 52,000 to 53,999 | 13750 |

| 54,000 to 55,999 | 14250 |

| 56,000 to 57,999 | 14750 |

| 58,000 to 59,999 | 15250 |

For automobiles with a FMV of more than $59,999, the annual lease value equals

(.25 x the FMV of the automobile) + $500.

For more information refer to IRS Publication 15-B.

| Mileage Rates | Business | Moving | Medical | Charitable |

| 2025 | 70¢ | 21¢ | 21¢ | 14¢ |

| 2026 | 72.5¢ | 20.5¢ | 20.5¢ | 14¢ |

Housing

At the end of the year your cash salary will be divided into "salary" and "used housing allowance". When designating a housing allowance your goal should be to guarantee you will be able to claim all of your out of pocket expenses as housing. If your housing allowance designation is too low you will be stuck with this lower amount even if your expenses exceed it. In addition, you do not want your housing allowance designation to be so close that if you have an unexpected expense it will not be covered. Because you must always designate the housing allowance in advance, you should over-designate your housing allowance. Aim to have unused housing at the end of the year. When you have unused housing allowance at the end of the year it means you were able to claim all of your housing expenses and you were not limited by the amount you designated.

Designate the housing allowance in a regular church/board meeting. Use the following wording:

Insert for Minutes of Meeting to Approve the Housing/Parsonage Allowance

1. It was discussed that under the tax law a minister of the gospel is not subject to federal income tax on the “housing allowance paid to him as part of his compensation to the extent used by him to rent or provide a home.”

2. The parsonage owned by the church has a rental value of $____________ and is provided for the convenience of the church. Actual utility expenses will be paid by the church and they will amount to approximately $__________________ for the year.

3. After considering the statement “Pastor’s Estimate of Home Expenses” (see next page) prepared by ____________________, a motion was made and seconded and passed to adopt the following resolution:

4. Resolved that Pastor _______________________ is to receive a total cash remuneration of $________ (salary) for the year 20____. Of this amount, $_______ (housing expenses paid from salary) is hereby designated as housing allowance.

5. Resolved that as long as Pastor _____________ is our employee the above amount of housing/parsonage allowance shall apply to all future years until modified.

Date____________ Signed__________________________________

Note: Using the above insert for the minutes is probably the most convenient for church use. The names of the individuals making the motion and seconding it should be included. If the church does not provide the home and pay the utilities, then the second paragraph is to be omitted. All out of pocket costs in providing your home are to be included in paragraph 4. IRS regulations state that the housing allowance should be designated in writing each year.

The Housing Allowance can be amended (changed) as often as needed. We always recommend overestimating when designating a housing allowance. The goal would be to have enough of a buffer in the designation to end up with unused housing at the end of each year. This eliminates the need to amend a housing allowance mid-year and, guarantees that a pastor will not be limited to the amount of his designation, but will be able to exclude all his housing expenses from income tax. It never hurts to designate too high, but it can hurt to designate too low.

At the end of each year your salary will be divided into two parts: taxable salary and non-taxable housing allowance.

It looks like this: You have a salary of $60,000 and you spend $30,000 in housing:

(#1) you had only $20,000 designated. Your taxable salary would be $40,000 and your non-taxable housing allowance would be $20,000 since you are limited to the amount designated.

(#2) you had $40,000 designated. Your taxable salary would be $30,000 and your non-taxable housing allowance would be $30,000 because you would be limited to the amount you actually spent on housing.

Theoretically there is no reason to lower a housing allowance since any unused housing would be considered taxable salary at the end of the year. Lowering a housing allowance is not necessary even in the event of a decrease in pay. Since the amount designated as housing allowance cannot be more than 100% of salary an amount designated that is higher than the salary would result in 100% of the salary being considered the designated housing allowance.

There can be a legitimate need to increase a housing allowance. The issue to keep in mind when amending a housing allowance is the fact that a housing allowance is never retroactive.

When it comes to the retroactive prohibition, there are two aspects of the housing allowance that need to be considered:

- A housing allowance is never retroactive when it comes to the expenses you pay.

This means you cannot "go back" and pick up expenses you have paid and consider them to be a part of your used housing allowance at the end of the year if you exceeded your designated housing allowance at the time you paid them.

It looks like this: if your designated housing allowance on May 31st was $15,000 and you had spent $18,000 on housing expenses at that point then you cannot "go back" and pick up the extra $3,000 of expenses by amending your housing allowance. You can amend your housing allowance so that you will be able to include your housing expenses from May 31st thru the end of the year but you have lost the ability to claim those extra $3,000 in expenses. - A housing allowance is never retroactive when it comes to the salary you receive.

This means you cannot "go back" and pick up salary you have already been paid and consider that to be housing allowance. You can amend your housing allowance to include future payments but not past payments.

It looks like this: You have a $60,000 salary ($5,000/month) and $20,000 of it was designated as housing allowance at the beginning of the year. At the end of October, you realize you will exceed the $20,000 housing designation. You can amend your $20,000 housing allowance to a maximum of $30,000 because you will have $10,000- or 2-months wages remaining in the year.

A pastor does not pay federal income tax on that portion of his income which is considered to be his housing allowance*. The housing allowance is the smaller of the following: The amount designated by the church to be considered housing allowance. (This is limited to ministry income, but 100% of ministry earnings can be designated as housing allowance). The amount actually spent to provide a home (see below: What expenses are included in the housing allowance?) The FMRV (Fair Market Rental Value) of the furnished home plus actual expenses. The FMRV takes the place of the mortgage payment (including closing costs, down payment, principal, interest, taxes, insurance) and major repairs.

*Housing allowance (parsonage value, church paid utilities and designated cash portion) is always subject to social security and Medicare taxes.

The pastor continues to be paid in the same manner he was paid prior to the designation of a housing allowance. The fact that a portion of his salary is now designated as housing allowance need not affect the amount nor the manner in which he is paid.

Housing Allowance is limited to the smallest of the following:

1. The amount officially designated for housing.

We recommend you estimate high because you do not want to be limited to what is designated. This can never be more than 100% of the income you earn from ministry. Other sources of income cannot be designated as housing allowance.

2. The amount you actually used to provide a home.

Housing is always out-of-pocket expenses, the amount you spend from your own personal funds.

3. The FMRV limitation (this applies when you own your own home).

The IRS is rather vague about how to figure your Fair Market Rental Value (FMRV). Your FMRV is an amount which you could collect in rent if you rented your home. A general rule of thumb for FMRV is one percent of the appraised value per month. For example, if the appraisal equals $100,000, the monthly FMRV would be $1,000. If you lived in your home for 12 months, the annual FMRV would be $1,000 x 12 = $12,000. This is only a general rule and does not apply in all areas of the country.

The FMRV limit takes the place of the mortgage payment, (including closing costs, down payment, principal, interest, taxes, insurance) and major repairs. Once you have determined your FMRV you would add to that the actual costs of utilities, decorator items, furniture, appliances, and miscellaneous expenses (such as repairs and cleaning supplies).

Rent or mortgage payments. Including principal, interest, real estate taxes, insurance, closing costs, and down payment.Furniture, appliances, computers, curtains, rugs, vacuum sweepers, washing machines, dryers, pictures, kitchen and garage utensils.Utilities: heat, electric, telephone or cell phone, water, cable TV, sewer charge, wood for fireplace, and internet.Cleaning supplies, brooms, light bulbs, lawn care.miscellaneous repairs.

The date a housing expense is considered to be paid depends on the type of payment:

| Cash: Expenses are considered to be housing allowance in the year they are paid. | $_____________ |

| Loan: Expenses are considered to be paid when the loan payments are made. | $_____________ |

| Major Credit Card: Expenses are considered to be paid the date of the charge. | $_____________ |

| Store Credit Card: Expenses are considered to be paid as the credit card payments are made. | $_____________ |

At the end of the year your cash salary will be divided into "salary" and "used housing allowance". When designating a housing allowance your goal should be to guarantee you will be able to claim all of your out of pocket expenses as housing. If your housing allowance designation is too low you will be stuck with this lower amount even if your expenses exceed it. In addition, you do not want your housing allowance designation to be so close that if you have an unexpected expense it will not be covered. Designate your housing allowance with a buffer built in because it is always good to have some unused housing allowance at the end of the year.

The following form may be used to help a pastor determine what amount of his salary he would like designated as housing allowance. Always overestimate, the amount a pastor cannot justify as being spent will be declared as income. It is important to keep accurate records of expenditures. The housing allowance can be amended in midyear, but the housing allowance is never retroactive.

Name of church __________________________________________________

Position held _____________________________________________________

Housing allowance for the coming year of 20___. I expect to incur the following expenses to rent or otherwise provide a home. I understand that my actual expenses are what I will deduct on my next year’s tax return, and I will not be allowed to deduct any expenses not estimated and designated officially.

| Amount | Item |

| Rent or payments on purchase of a house including down payment, principal payments, interest, taxes, and improvements |

$_____________ |

| Furnishings and appliances | $_____________ |

| Utilities | $_____________ |

| Other housing expenses (cleaning supplies, etc.) | $_____________ |

| Miscellaneous repairs | $_____________ |

| Total | $_____________ |

Signature__________________________________

Date ________________

When a pastor lives in a church owned parsonage its value is considered a part of his housing allowance and is automatically free from income tax*. In addition, a pastor does not pay federal income tax on that portion of his cash income which is considered to be his housing allowance.

*Housing allowance (parsonage value, utilities paid by the church and designated cash portion) is always subject to social security and Medicare taxes.

A pastor who lives in a church owned parsonage has 2 parts to his housing allowance.

Part One: The first part is a value that he receives and not a part of his cash salary. It includes the fair market rental value of the parsonage and any utilities which are paid by the church.

Part Two: The second part is the portion of his cash salary which is designated as housing allowance. This part continues to be paid to the pastor along with his regular salary. The pastor keeps track of his own personal housing expenses and is able to exclude one of the following amounts, whichever is less.

1. The amount of the pastor’s cash salary which is designated by the church to be considered housing allowance.

2. The amount actually spent (see below: What expenses are included in the housing allowance?)

Many pastors living in a church owned parsonage do not have any of their cash salary designated as housing allowance and do not take advantage of this benefit.

How do you determine the fair market rental value of the parsonage?

Because a pastor must pay self-employment tax (Social Security and Medicare) on his housing allowance, it is important that you set a conservative yet reasonable value. While good stewardship would suggest a more conservative figure, it would be wrong to understate the value. Churches are responsible for determining the fair market rental value of the parsonage but generally the church and pastor work together to arrive at this figure. There are many elements to consider in setting a fair market rental value, such as condition, location, current demand and economic conditions and you may wish to consult a realtor or appraiser.

What expenses are included in the housing allowance?

The following expenses, when paid by the pastor, are included in part two of his housing allowance.

1. Improvement, repairs, and upkeep. This includes a room addition, new roof, fence, sod, swimming pool, garage, refrigerator repair, etc.

2. Furnishings and appliances. Including dish washer, TV, personal computer, pool table, piano, dishes, blender, lawnmower, etc.

3. Decorator items. Such as rugs, curtains, pictures, plants, knick knacks, wallpaper, paint, towels, bedding, etc.

4. Utilities. Electric, garbage, water, telephone (not business), cable TV, internet, gas, water softener rental, etc.

5. Miscellaneous. This would include cleaning supplies, light bulbs, dry cleaning of drapes, carpet cleaning, landscape tools, garden hose, etc..

For years I have advised churches to get out of the parsonage business. I think it is very important to get a pastor into his own home as soon as possible for many reasons.

- Retirement – owning a home at retirement is a key ingredient to retirement planning.

- Security – for his family, particularly his wife. Privacy – they can decorate how they want -it’s home.

- I think it tends to add to longevity – the family feels more attached to the community because there’s a stronger sense of belonging.

- Tax purposes – income tax law provides for generous benefits to the pastor who is buying his own home. Federal and state income taxes are greatly reduced and sometimes eliminated due to the housing allowance and double deduction for mortgage interest and real estate taxes. (Unfortunately, it has no affect on the pastor’s most burdensome tax, his self-employment tax.)

The church sells the parsonage to the pastor. The pastor assumes the balance of the mortgage and signs a note for the difference between the selling price and mortgage balance, to be paid with, or without, interest at a future date, or when residence is sold.

The Pastor purchases a home through Conventional Financing. The down payment is acquired from the sale of the parsonage to be repaid with or without interest at a future date or when residence is sold.

There are three ways this can be accomplished:

1) The church purchases the home and sells it to the Pastor on land contract using the church assets as collateral. 100% financing is not unusual*.

2) The Pastor purchases a home through Conventional Financing. If the church cannot supply the down payment, it can be acquired from individuals (i.e. church members) with interest* and principal payments deferred, but interest accruing* until home can be refinanced (i.e. after five years when Pastor can afford larger mortgage payments).

3) A building program can be timely. More bonds can be sold or additional financing secured to be used as a loan to the Pastor for the purpose of buying his home.

*In the past loans in excess of $10,000 would require interest be assessed. However the IRS no longer requires interest be assessed for a pastor with less than $1,000 of investment income (interest, dividends, capital gains, etc.) on loans not exceeding $100,000 (IRC 7872(d)). If the pastor has more than $999 of investment income, interest must be assessed on loans over $10,000. You need an interest rate, which is equivalent to the federal discount rate.

Many churches help their pastors get into a home by providing money for a down payment. These funds can be a taxable gift and become taxable income in the year they are received and may be designated as housing allowance OR the funds can be considered a loan to the pastor. Churches that “loan” money to their pastor need to be aware of several things.

1. In the past loans in excess of $10,000 would require interest be assessed. However the IRS no longer requires interest* be assessed on a loan of less than $100,000 for a pastor with less than $1,001 of investment income (interest, dividends, capital gains, etc.). If the pastor has more than $1,000 of investment income, interest must be assessed on loans over $10,000. You need an interest rate, which is equivalent to the federal discount rate. There are two ways to assess interest:

- METHOD 1–CANNOT BE DESIGNATED HOUSING ALLOWANCE Multiply the amount of the loan by the interest rate and add that amount to the pastor’s wages on his W-2. No money actually changes hands. (Example: $15,000 x 3% = $450. The church would add $450 to block 1 of the W-2.) Because the pastor never actually makes an interest payment to the church the interest payment may not be housing allowance.

- METHOD 2-CAN BE DESIGNATED HOUSING ALLOWANCE Multiply the amount of the loan by the interest rate and add that amount to the pastor’s income as housing allowance in block 14 of the pastor’s W-2. This increases the pastor’s total income by $450. (Example: $15,000 x 3% = $450) Using a salary reduction the pastor pays the interest back to the church each pay period. (Divide $450 by the number of pay periods. $450 divided by 12 = $37.50. If there are 12 pay periods per year the pastor would have $37.50 deducted from each paycheck to pay the interest due to the church.) The advantage to this method is that the interest payment may be designated housing allowance as long as the loan is secured by the home.

2. There is no such thing as a “contract” for forgiveness either written or verbal. (When such a contract exists the IRS would recognize the entire contracted amount to be income in the year of the contract.) Churches who wish to give their pastor’s a loan are free to do so. If after a year or several years they wish to forgive all or a portion of the loan they may do so (but they cannot forgive the loan via a contract). The forgiven amount becomes taxable income in the year forgiven (and it may be designated housing allowance if the loan is secured by the home), however the church may not make an agreement to forgive an amount in future years.

3. The loan needs to be secured by the home.This is necessary in order for any interest payments, loan payments or future forgiven amounts to be considered housing allowance and to be deductible as mortgage interest on Schedule A.

*IRS Code Sec. 7872(d)

Retirement

Hanging up the phone the pastor had a knot growing in the pit of his stomach as he had just been informed that his life savings had been lost by a friend in an investment. Hindsight started to overwhelm him, he had some doubts when he did it but the trust factor had taken over. Now he was questioning his judgment, and rightly so. How does he tell his wife that at retirement age their savings are gone, the IRA is gone, and the home that just 2 years ago was debt free is now mortgaged to the hilt?

What is sad is that the above story is true, having recently happened to a pastor friend of mine. Is this story an exception? I would like to say yes, but I can’t. In my 45 years of ministry this story has repeated itself many times over. The results have been devastating to the family and with virtually no time in their working life to recover financially.

Is God sovereign? Of course. Will the Lord take care of their needs? Yes, and this family knew that. When I met with them, they were fully trusting that the Lord would provide. And He will. In fact, he already has.

The church’s response was immediate. The Lord worked in the hearts of the board and congregation in a very special way. The love and affection expressed to him, and his family was overwhelming. As of this writing the church has provided immediate financial help and a provision in the budget which provides for a long-term retirement benefit for him and his wife. Was this required by the congregation? No. Was it the right thing to do? Absolutely and I believe the Lord will richly bless the church for their care and generosity. Will the pastor have to earn income in his retirement? Yes, and the Lord will provide here also. His pastoral and counseling skills will allow him to continue working in an area he loves. Isn’t God good?

Are there lessons to be learned from this pastor’s experience? Yes. Let me list some:

Personal Stewardship – This pastor obviously got himself into a situation that was beyond his area of expertise:

- Pastors should be very cautious about investing with people in their congregations, it can easily become a catch 22 situation. If he’s not satisfied with the handling of his account, how can he make a change without offending a member of his church?

- Pastors need to ask questions or seek counsel from someone with no conflict of interest who has expertise in that area.

- Listen to the counsel!!

- People who delay their retirement planning until later in life are more vulnerable to the “get rich quick” scenarios. Will Rogers once said, “I’m not as concerned with the return on my money as I am the return of my money”.

- Pastors are not trained to be investors (not many people are). They do not have the time to do the homework, make sure the investment vehicle is sound, has a strong measure of safety, and is managed by competent investors with a track record of experience. A pastor in his 50’s or 60’s does not have time to recover if he makes a mistake.

- When possible, the church needs to get the pastor into his own home. The first pre-requisite of retirement is to have a home paid for at retirement. (Not to ignore the security issue, privacy, longevity and tax advantages which are also benefits to owning his own home.)

- The church should help him fund his retirement plan with the goal of his receiving 80% of his take home pay from Social Security and his retirement plan at retirement.

- To accomplish the above he needs to begin funding his retirement as early as possible, it should at least begin by age 40 with $4,000 per year, increasing annually to meet the desired results. If he has opted out of Social Security his plan needs to be more aggressive.

- The 403-b family of plans is the most advantageous of retirement plans for pastors. The contribution can be up to 100% of income with a maximum of $24,500 per year ($32,500 if he is age 50 or older**). In addition, if he has been in the ministry for 15 years, he can add a $15,000 lifetime make-up at a maximum rate of $3,000 per year. The distinct advantages of the 403-b are the church makes the deposit (which can be from salary or in addition to salary), the amount deposited is exempt from the self-employment tax, and the distributions are eligible for the housing allowance at retirement. Pastors should not be in IRAs and rarely Roth IRAs.

** Special Ages 60–63 Catch-up $11,250 (Additional salary reduction contributions which replace the age 50 or over contributions for ages 60, 61, 62, and 63). At age 64, the catch-up drops back to the lower age 50 amount.

Answers to Common Questions:

- I recommend the 403-b plan because IRA’s do not have the characteristics for pastors as does the 403-b. That is the Social Security tax savings and the housing allowance feature explained in “4” above.

- I am not aware of any disadvantages to the 403-b pension plan.

- The 403-b can be invested into the same vehicles as any pension plan. Bonds, stocks and etc. an experienced broker will counsel you based on your objective.

- The 403-b catch-up is for pastors who have been in the ministry for 15 years (not necessarily with the same church). The lifetime catch-up maximum is $15,000; the annual catch-up maximum is $3,000.

- Contributions to the 403-b pension plan must be made by December 31 of the year in question. Whereas an IRA contribution can be made up to April 15th of the following year.